About nine years ago, I sat down with a leader over about 6,000 people in the local church. I had just given a talk to a large group of his church members about finances, talking to them about getting out of debt, saving money, and learning to spend less than they make. At the time, not many people were interested in saving as their savings were far outpaced by the "equity" in their homes rapidly rising in unprecedented ways.

I remember the leader asking me what I thought about the economy. Mind you, I had been a wholesale loan officer for six years, so my view was slanted toward housing. I remember telling him that the economy looked great, and that people who said we were in a recession were crazy.

Boy was I wrong. Blindingly, stupidly wrong.

I still feel foolish about it. Of course, if the congregants had followed my advice and paid off debt, saved money, and changed their spending habits, the Great Recession wouldn't have hurt them as bad. But still, I was blind to the indicators.

I'm going to learn from that.

Right now a lot of those indicators are back, but just in different sectors of the economy. We do not have a stupid mandate from the federal government to give housing to people who are not creditworthy, thus artificially propping up the housing market; what we do have, is another mandate from the Federal Reserve to prop up the stock market with artificially low interest rates and quantitative easing (QE, or essentially printing money out of thin air), thus creating a phony "recovery" from the Great Recession of 2008. We switched from housing to stocks (and bonds by way of raising their values, which are inverse to interest rates). Through this mechanism, the entire economy has been propped up on a phony recovery.

So, here we go again. After seven to eight years of loose housing policy, we had HUGE unintended (or intended, depending on your viewpoint) consequences from which we have never recovered; since then, we have had seven to eight years of historically, unprecedented loose monetary policy (zero interest rate policy, or ZIRP), and I think we are on the brink of another collapse, but this time it could be bigger.

Here's why:

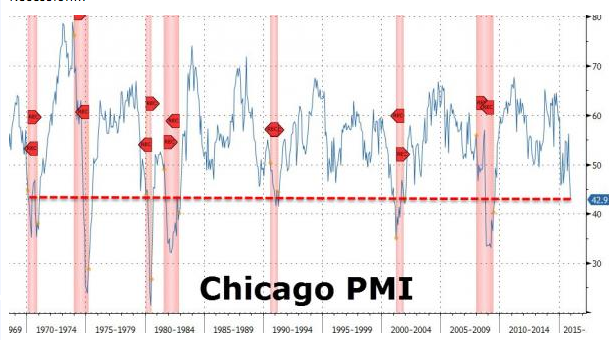

1. Manufacturing is already in a recession. Se the chart below, and note anything below 50 is considered recessionary. This recession is NOT confined to manufacturing, as you can see in point #2.

Source Zero Hedge, 2015.

2. The retail and energy sectors took a huge hit in Q4 of 2015, and 2016 is off to a terrible start. Several large companies announced job reductions, some of the biggest layoffs since last year when we nearly slipped into a full blown, admitted recession. Read here.

3. Recessions are preceded by bubbles, caused by terrible monetary/regulatory policy. After seven to eight years of a phony economy built on artificially low interest rates, that has inflated a stocks and bonds bubble, it has started to crash. January was the WORST JANUARY EVER for the stock market. Let that sink in for a bit. See here, here, and here.

4. Q4 GDP was revised down to .7%, but will probably be revised lower later. Remember, you never know you were in a recession until you're past it. A recession is usually defined as two consecutive quarters of negative GDP growth (Investopedia, 2016), but it doesn't have to be. Regardless, we are in recession territory, if not already there. If you want to see, go check your 401k statement, and be ready to see losses.

5. The same people who I followed into being blind about it last time, are saying the same thing this time, namely the mainstream news media, politicians, and the Fed. They are denying the underlying weakness in the economy by pointing to false government indicators of strength. Right up until the housing crash, many were saying there is no way it would crash. DON'T LISTEN TO THOSE PEOPLE! Unless they have changed their tune and admitted their mistakes, they will lead you down the same path.

6. Janet Yellen, the chairperson of the Fed, just announced that they will do negative interest rates if necessary, totally backing down from their stance of raising interest rates four times this year. They see the warning signs, so we should too! Richard Fisher, another Fed official, formerly the Dallas Fed governor, called the Fed's money injections "cocaine" and "heroin" to Wall Street. Is that a good thing?! No!

What can you do about it? We have a few maxims in our company that we use as hashtags on social media. The main four are: #SpendLessThanYouMake, #LiveDebtFree, #SECUREYourRetirement, and #StopOverpayingTaxes. I would add to that mix, #Save10PercentOfYourIncome and #PayYourselfFirst to that. These are time-tested financial principles that have worked for literally thousands of years.

Here are a few more things you can do: 1. Seek out good, professional advice, in finances, tax, and legal questions; a good financial advisor should help you earn up to 3% MORE THAN someone who has no advisor (Vanguard, 2014); 2. Only invest in things you understand or with which you are familiar; 3. Have a written debt plan to be out of debt, and a written retirement plan you can follow; 4. Look at moving into precious metals with five to 10 percent of your portfolio (gold is set to make large gains).

These are just some suggestions, but really it all comes down to spending. If you learn to #SpendLessThanYouMake, you'll find wealth in an up or down market. From there, the planning becomes crucial.

Are we in a recession? More than likely, yes; don't be fooled by only GDP numbers, because if it were not for the government creating money out of thin air, we would definitely be in a recession and the GDP numbers would be MUCH lower; all of that can change if the government or Wall Street fudges statistics. Regardless, there is a large correction coming, and it needs to come to clear out malinvestment. So, GET YOUR FINANCES IN ORDER, and get some good advice and good planning now, not later.